How much is an SREC worth in Pennsylvania?

How much is an SREC worth in Pennsylvania?

Blog Article

Pennsylvania's solar energy market is rapidly growing, thanks to incentives like Solar Renewable Energy Certificates (SRECs). These certificates offer significant financial benefits for solar system owners, helping to speed up the return on investment and supporting the state’s renewable energy goals. In this article, we’ll explore how SRECs work, their value, and the future of the Pennsylvania SREC market.

What Are Solar Renewable Energy Certificates (SRECs)?

SRECs are credits that represent the environmental benefits of generating one megawatt-hour (MWh) of electricity from solar power. When a solar energy system produces electricity, it earns SREC credits, which can then be sold separately from the electricity itself. This allows homeowners and businesses to generate additional income by trading these certificates, making solar energy even more financially rewarding.

How Do SRECs Work in Pennsylvania?

The Pennsylvania SREC market has seen rapid growth due to various state and federal incentives. SRECs in Pennsylvania can be sold to utilities, who need them to meet renewable portfolio standards (RPS). These standards require a certain percentage of electricity to come from renewable sources, and utilities purchase SRECs to fulfill these mandates.

However, Pennsylvania’s SREC market was significantly impacted by Act 40 in 2017, which limited SREC eligibility to solar systems within the state. This helped stabilize the market by preventing out-of-state systems from flooding the Pennsylvania SREC market.

Will SREC Prices Go Up in Pennsylvania?

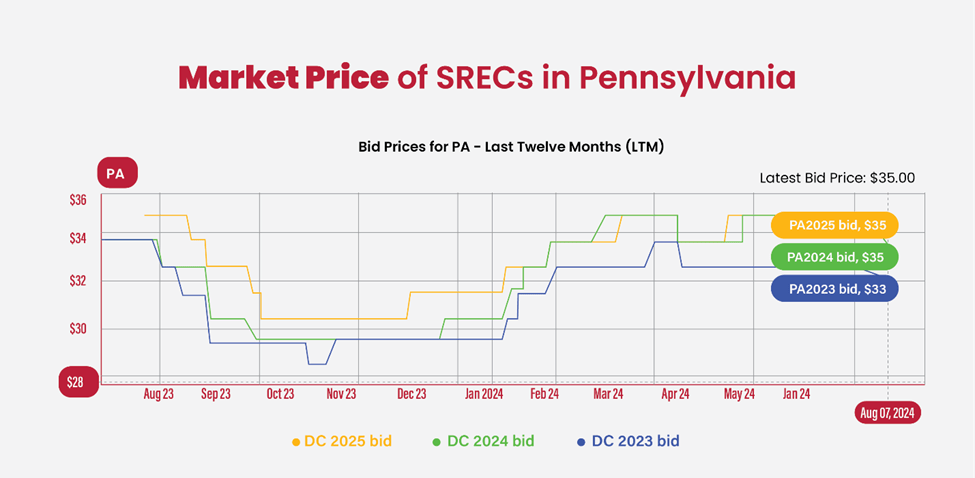

SREC prices in Pennsylvania are influenced by supply and demand. As solar adoption increases, so does the supply of SRECs, but the demand from utilities to meet renewable energy goals continues to drive prices. Currently, the price for an SREC in Pennsylvania is around $35 per credit. The future of SREC prices will depend on factors like changes in energy policy and the pace of solar installations.

Maximizing SREC Earnings

For solar system owners, selling SRECs is a great way to increase the financial returns on their investment. Platforms like SRECTrade make it easy to register, track, and sell SRECs. This platform allows you to connect with buyers and manage your certificates efficiently, ensuring you get the best market price.

Are SRECs Taxable?

Yes, income from selling SRECs is generally considered taxable. Homeowners and businesses should consult with a tax professional to understand how this income impacts their financial situation.

What Is the Lifespan of SRECs in Pennsylvania?

SRECs in Pennsylvania are valid for three years from the time they are issued. This allows solar system owners some flexibility in deciding when to sell their certificates for the best price.

Conclusion

SRECs are a powerful tool for encouraging solar energy adoption in Pennsylvania. what is a srec They offer financial rewards to solar system owners while helping the state meet its renewable energy targets. As the solar market continues to grow, platforms like SRECTrade will be essential in helping homeowners, businesses, and investors maximize their SREC earnings.

Report this page

Report this page